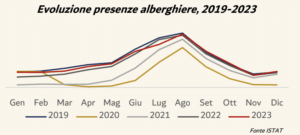

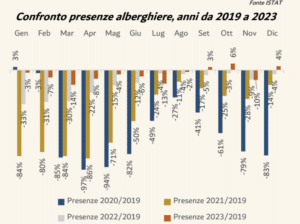

In the 30 years leading up to 2020, demand for Italy grew at a pace of about +2.8% (hotel arrivals, compound annual growth rate), with foreign arrivals even increasing at a CAGR of +3.2%. Before the total shutdown of travel, Italy’s tourism demand was strong (281 million overnight stays in 2019), with the international market accounting for 50% of the total hotel volumes. Following the outbreak of the pandemic in 2020, a slight and gradual recovery in presences was observed during 2021, despite a persistent negative trend in the volumes of occupancies in the early months of 2021. In fact, it was starting from the summer season, particularly from July, that the gap compared to the pre-pandemic period began to narrow. On an annual level, compared to 2019, 2021 still recorded a -41% drop in overall presences. In 2022, the gap compared to 2019 further narrowed.

The first quarter of 2022 saw occupancies volumes around -31% compared to 2019. This was an improvement from the -82% in the first quarter of 2021 and mainly in line with the first quarter of 2020 when there were no restrictions (except for March 2020). The 12 months of 2022 closed at just below -14% compared to the same period in 2019. In 2023, with almost 268 million presences, there was a partial alignment (-5%) in volumes compared to 2019. The months of January and February positioned themselves at -3% and -7% compared to 2019; the definitive recovery from the pandemic effects occurred in September, October, and December with +3%, +6%, and +4% respectively compared to the same months of 2019.

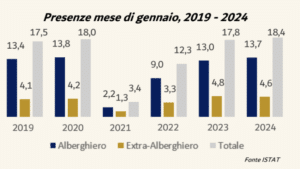

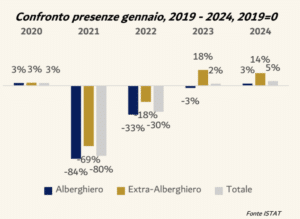

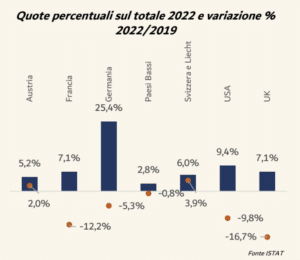

During 2020, Italy’s main foreign hotel markets experienced significant declines compared to 2019. The overall drop of the top 7 foreign markets was -51.7%, with US overnight stays plummeting by 77.2%. Other particularly affected source markets were the Netherlands, with a decrease of about 82.1%, and Germany with -52.8%. The Swiss market decreased the least, by 21%. In 2021, however, some foreign markets even increased their share of total foreign presences. These markets were Austria, Switzerland, and France. In 2022, only the hotel occupancy from Austria and Switzerland exceeded their respective 2019 volumes. The US and UK regained their share compared to 2019, while Germany lost weight in the total foreign hotel presences. In recent days, ISTAT published the tourist presences registered in January of this year, reaching 18.4 million (the highest volumes recorded in the years in question), an increase of 2.1% compared to 2020 and 3% compared to 2023. Considering that in January 2020, it was still possible to travel without any restrictions, hotel occupancies were at 13.8 million (the highest volumes recorded in the years in question) and non-hotel occupancy at 4.2 million.

In January 2024, the hotel segment reached 13.7 million occupancies (-0.5% compared to 2020 and +5.2% compared to 2023) and the non-hotel segment 4.6 million (+10.7% compared to 2020 and -3% compared to 2023). On the other hand, the growth in occupancies in the non-hotel segment compared to 2019 was particularly significant (+18% in 2023 and +14% in 2024).